Property Taxes

Property taxes are levied twice a year by an Interim and Final Notice. The Interim billing reflects taxes due for the first six months of the year billed with three instalment due dates. The Final billing reflects taxes due for the last six months of the year, also with three instalment due dates.

Typically, each bill requires payment in three sequential instalments; the Interim Bills are usually sent in January with payments due in February/March/April and Final Bills are typically sent out in June with instalments due in July/August/September; each instalment (payment) covers two months of taxes.

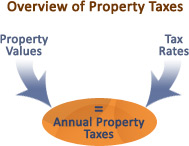

- Taxes are generally calculated by multiplying the tax rate by the assessed value of the property.

- The City collects and distributes tax dollars on behalf of the Region of Peel and the School Boards however, the City does not determine their rates.

- The Municipal Property Assessment Corporation (MPAC) determines the assessment value of a property. Homes are assessed, based on a number of factors including: lot size, square footage, the number of bedrooms and bathrooms, finished basements, fireplaces, etc.

Tax Payment Options

- Payment is expected in three instalments (for each 6 month period) as indicated on the tax bill.

- Payment methods are cheque, debit, in person at a bank or through a bank's web site or via pre-authorized payment plan.

- Credit card (note: Additional fees apply for this service)

- There are three pre-authorized tax payment plans (PTP) options available to taxpayers: monthly at either the beginning or middle of the month, or 6 times per year on the actual instalment date.

How to Calculate Taxes

For residential properties, annual taxes are calculated by multiplying the Assessment Value shown on your tax bill by the appropriate tax rate.

For example: Residential & Farm (Tax Class RT) assessment value

x current tax rate

= annual taxes due

Please Note: Properties in the Commercial, Industrial and Multi-Residential tax classes are subject to legislated adjustments and cannot be accurately calculated in this manner. Requests for calculations should be forwarded to the Tax Section

Interim Taxes

- Interim taxes are based upon

50 percent of the previous year's annual property taxes, and are adjusted for any cancellation or supplementary taxes. Such adjustments are recalculated as if they had applied for the entire year.

- The assessed value of your property is based on the current value of the property as of January 1st of the respective year. Any changes to the succeeding year’s taxes will be reflected on the Final Tax Bill, which is issued in the latter half of the year.

- For accounts that did not exist in the previous year, interim taxes are approximately 50 percent of a full year's estimated taxes.

Final Taxes

- Final taxes are billed around the middle of each year after the budgets for the Region and City have been approved and the Province of Ontario has set the education tax rate. Final taxes paid by individual homeowners are based on the assessed value of their homes and the annual tax rate.

Impact of Re-assessment

- MPAC completed a province wide re-assessment of properties throughout Ontario in 2016

- Properties are assessed based on their estimated market value as of January 1, 2016

- The average increase for the residential class for Brampton was approximately 26.33%. Taxpayers will see the increase phased in over the next four years, approximately 6.5% per year. Any reductions from assessment decreases are immediate.

- The increase of assessment does not increase the tax revenue to the City. By provincial law, municipalities must reduce their tax rates to offset all of the assessment increases.

- Properties increasing at the average will not see an assessment based tax change. As you move away from the average, tax changes will be seen.